Dreamsaver Wedding Insurance

Pros

- Eight levels of cover to choose from

- UK and abroad coverage

- Many types of wedding covered including military and civil ceremonies

- Optional COVID-19 cover

- Good choice of levels of cover with the options to add extras

- Large £80,000 cancellation cover available

Cons

- Starting policy price is higher than some other wedding insurance providers

- £100 excess across the policies

Getting the right wedding insurance for your special day is so important. You need to make sure that all of the financial aspects of your big day are covered in the event that something goes wrong. However, with a lot of wedding insurance providers out there, choosing can be a challenge.

Dreamsaver wedding insurance offers comprehensive cover on various types of weddings. I was really pleased with the diversity of what was on offer and in my Dreamsaver wedding insurance review, I’ll cover everything you need to know.

Dreamsaver Wedding Insurance Overview

Dreamsaver offers wedding insurance both in the United Kingdom and for weddings that are taking place overseas. The sheer variety of cover is incredible and this made me feel as though I could find the perfect insurance for my needs.

Whether you’re having a military wedding, getting married in a civil ceremony or need public liability cover, Dreamsaver wedding insurance has a range of packages to choose from. Moreover, I was very happy to see that they are now offering Covid Cover, one of the first UK wedding insurance providers to do so.

However, if you are unable to go ahead with the wedding because of COVID-19, there are some stipulations on when you can claim. In a nutshell, only the bride, groom or a close family member should be affected and they must have contracted the illness at least 10 days prior to the wedding.

What I also really liked about the experience of browsing the Dreamsaver website was that there is a lot of information on various aspects of getting married such as planning tips, honeymoon

ideas and more. It felt like a whole package in one.

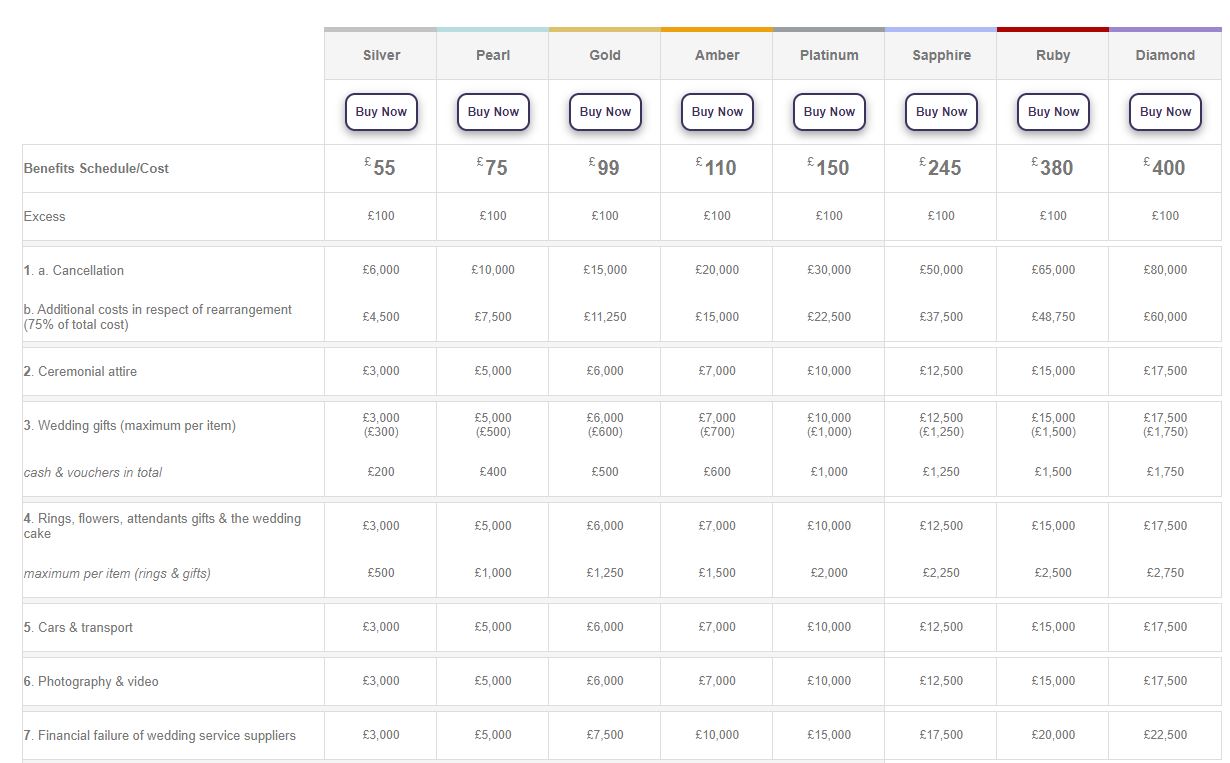

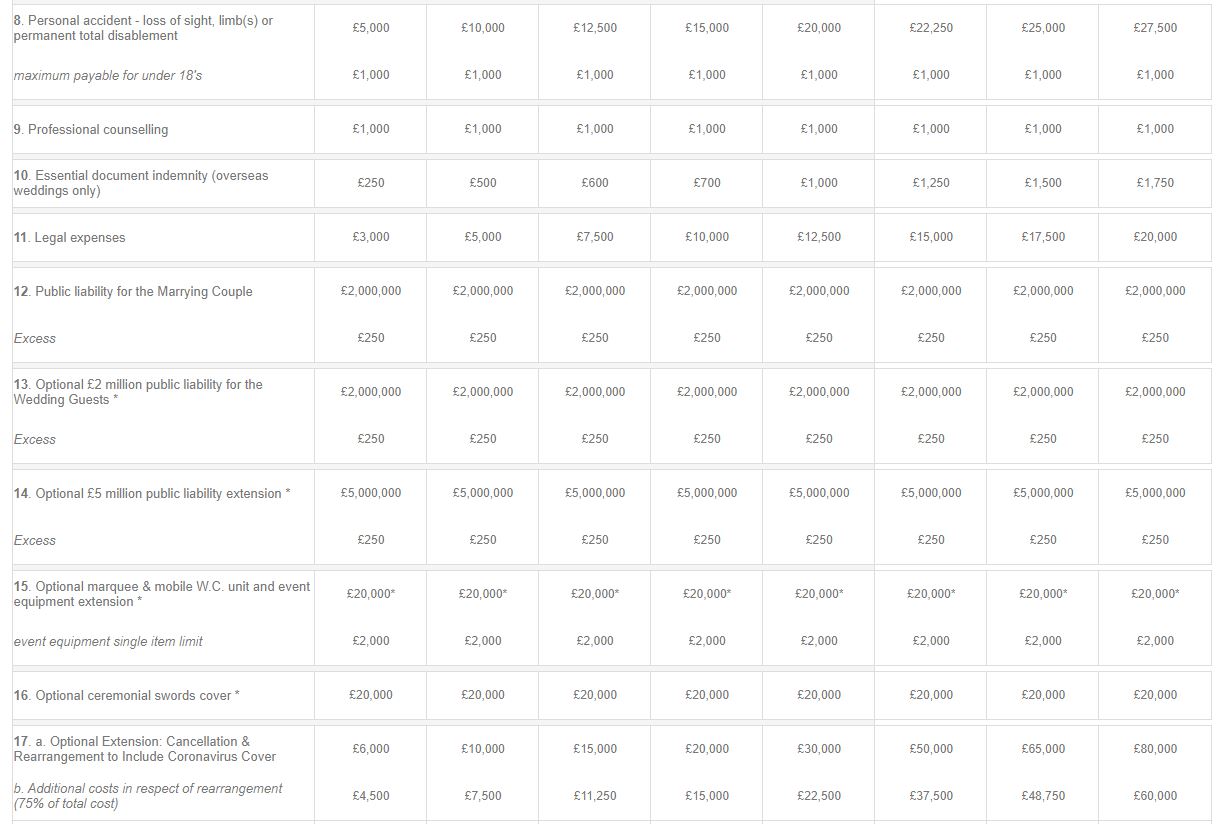

Levels Of Cover

There are 8 levels of cover offered by Dreamsaver wedding starting from just £55. Yes, this is a little higher than some providers but there are those that are a lot pricier. For me, I felt that the prices were reasonable, especially considering what you get for your money.

The 8 packages include the silver package, pearl package, gold package, amber package, platinum package, sapphire package, ruby package and the diamond package. At the top level, you’ll pay a premium of £150 but this does get you up to £2 million in public liability cover, up to £30,000 cancellation cover, £10,000 in wedding attire and a whole host of other benefits.

What Is Covered By My Policy?

All of the policies offered by Dreamsaver wedding insurance cover the following things. However, you must keep in mind that the amount of cover for each of these differs and you can find out more information by looking at the table on their website.

- Cancellation cover

- Wedding attire

- Wedding gifts

- Rings

- Flowers

- Attendant Gifts

- Cake

- Transport

- Photography and video

- Failure of suppliers

- Professional counselling

- Personal accident cover

- Essential document indemnity for weddings abroad

- Legal expenses

- Public liability for bride and groom or wedding guests

- Optional cover including marquees and ceremonial swords

For the diamond package, there is also an option to upgrade your cancellation cover to £50,000 as well as the choice to add on COVID-19 cover on all policies.

Understanding Your Policy

It’s important to keep in mind that you must take your policy out at least 14 days before the date of the wedding in order to be covered.

However, if you are unsure of anything, there’s a really helpful section of the website that contains definitions of all the legal jargon

Making A Claim

Making a claim on your Dreamsaver wedding insurance policy is pretty straightforward. I did notice some reviews stating that claims were dismissed but these were based around the COVID-19 pandemic in 2020 when wedding insurers were not offering this type of cover. In any case, I’d really urge you to properly read your documents so that you know exactly what is covered.

If you do need to make a claim, you will need to do so either in writing, via email or by calling 0345 040 5975. It’s essential that you notify the company of your intent to claim as soon as possible and there are limits on how long you can leave it. Claims made more than 31 days after an incident may not be valid. Moreover, if you’re claiming on wedding cake damage, you only have 48 hours to let Dreamsaver know.

Customer reviews about the company are all pretty positive and I’ve found nothing that suggests making a claim would be difficult.

Dreamsaver Policy & Tier Chart

What Are The Pros and Cons Of Dreamsaver Wedding Insurance?

Dreamsaver Promotional Codes and Voucher Codes:

Dreamsaver FAQs

How many levels of cover does Dreamsaver offer?

Dreamsaver wedding insurance offers eight levels of covers with premiums between £55 and £400. There is the option to pay extra to add on things like additional cancellation cover and COVID-19 cover.

Why do I need Dreansaver wedding insurance?

While it’s nice to think that nothing will go wrong with your big day, there may be things outside of your control that have a financial impact. Having wedding insurance ensures that you won’t have to cover any costs or lose out on money you have already paid.

Can I make a claim if my partner backs out of the wedding?

Sadly not. Wedding insurance is designed to cover issues outside of your control. One member of the couple deciding not to go ahead is a voluntary decision and therefore is not covered.

I’m having a civil ceremony and a church wedding on separate days, am I covered for both events?

Your Dreamsaver policy covers one wedding and one reception and they must take place within 21 days of each other. However, you may be able to purchase separate cover for additional dates and you can contact the insurer to discuss your needs.

My fiance is not a UK resident, will Dreamsaver still cover our wedding?

Dreamsaver is a UK based company and asks that at least one of the couple to be married is a UK resident. If your partner is not, but you are, you’ll still get cover.

Are existing medical conditions covered?

In most cases, any medical conditions that you are already aware of will be covered. However, if you are awaiting treatment or have been given a terminal prognosis, this will not be covered.