InsureMyDay Wedding Insurance

Pros

- Good selection of policies offering various levels of cover

- Up to £80,000 cancellation cover without an excess charge

- Optional extras

- Easy to make a claim

- Excess on everything else is just £75

- Clear and easy to use website

Cons

- No Covid-19 cover

- Only covers weddings in the UK

- Policies are somewhat more expensive than some other providers

There are a lot of important things you’ll need to remember for your big day but none are quite as important as a good wedding insurance policy. Without this, you are putting yourself at serious financial risk so I’d always advise researching wedding insurance policies to find one that’s right for you.

With lots of companies offering policies, it can feel confusing so I’ve been reviewing several to give you a better idea of what’s on offer. In this review, I’ll be looking at InsureMyDay, a company that offers premium wedding insurance. The information here is intended to give you a clear picture of the company and help you make a decision on whether it’s the right insurer for your special day.

InsureMyDay Wedding Insurance Overview

InsureMyDay is a wedding insurance company that offers premium policies. One of the highlights of this particular insurer is that you can get up to £80,000 worth of cancellation cover without having to pay an excess. However, one thing I did notice was that the cost for the lowest policy is a little higher than some of the competition.

That said, InsureMyDay has a lot of options to add on extras such as marquee cover and public liability, among other things. Everything is detailed clearly on the website so there’s no need to second guess what you’re purchasing.

Another thing that really caught my eye about this insurer was that the claims process can all be done online so it’s really hassle-free. Of course, I’ll go into this and everything else in more detail throughout this review.

Levels Of Cover

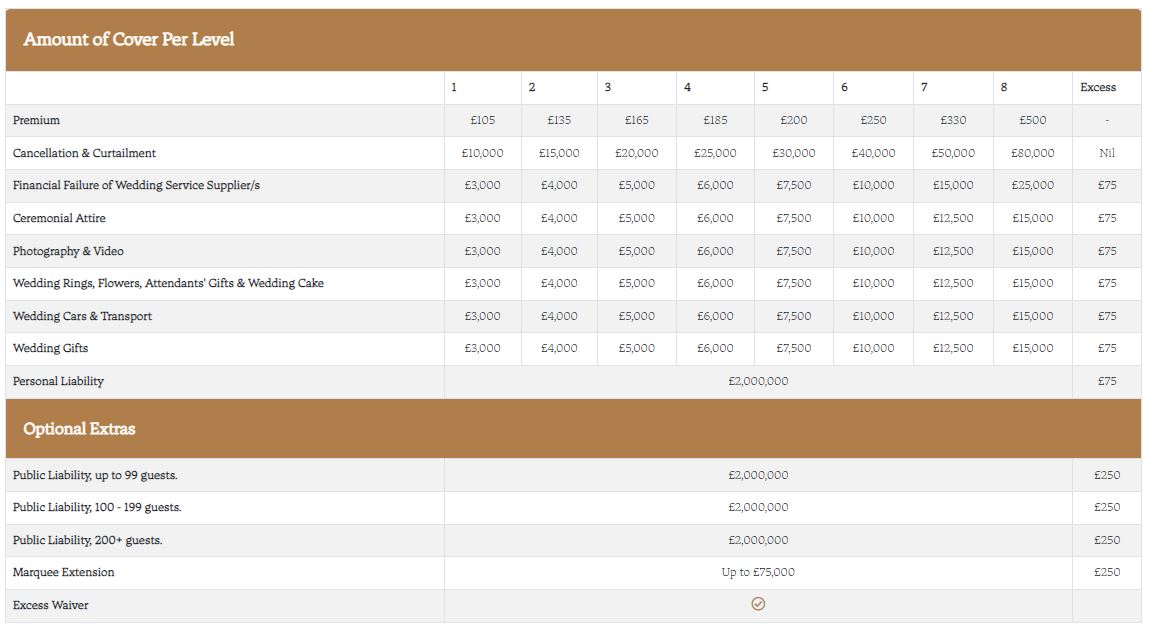

As with most wedding insurers, InsureMyDay offers a variety of packages to suit different needs. Which you choose will depend on the scale and cost of your wedding and packages range from £108 through to £500 for the top tier policy.

At the most basic level, you get up to £10,000 in cancellation cover and there’s no need to pay an excess on this. As you move through the packages, the cancellation cover gets higher with the top tier giving you up to £80,000.

While there is no excess on the cancellation cover, it is worth noting that, should you make a claim on anything else within your policy, you will need to pay a £75 excess fee. This includes things like personal liability, attire, photos and other similar things.

What Is Covered By My Policy?

All of the policies offered by InsureMyDay cover the same things at their most basic level. The only difference between each policy is the amount of cover for each of the following aspects:

- Cancellation cover

- Failure of suppliers

- Wedding attire

- Photographs and video

- Wedding rings

- Flowers

- Attendant gifts

- Wedding cake

- Cars and transport

- Gifts

- Personal liability

In addition to these things, InsureMyDay also offers the chance to add extra which include public liability up to £2 million and marquee cover.

Understanding Your Policy

The InsureMyDay website makes everything very clear and easy to understand. But of course, if there’s one thing I’ve learned about wedding insurance over the years, it’s that there can be some confusing technical jargon.

I like the fact that there are easy to access details for post, email and telephone that allow you to get in touch with the company to discuss anything you aren’t sure about.

There’s even a dedicated customer portal where you can check the progress of your claim or download your policy documents.

Making A Claim

One of the things that I found incredibly simple with InsureMyDay was the claims process. I have known some to be more complex than they need to be but with InsureMyDay, everything is done online via the customer portal I mentioned earlier on.

There are also dedicated methods of contact that you can use to check on the progress of your claim so you won’t be left wondering what’s going on.

InsureMyDay Policy & Tier Chart

What Are The Pros and Cons Of InsureMyDay Wedding Insurance?

InsureMyDay Promotional Codes and Voucher Codes:

InsureMyDay FAQs

Does my policy cover pregnancy or childbirth?

No, you InsureMyDay wedding insurance policy does not cover childbirth or pregnancy. However, you may be able to make a claim if the wedding cannot go ahead because of a medical condition related to pregnancy but only if the due date is two months after the date of the wedding.

Are pre-existing medical conditions covered by my policy?

Pre-existing medical conditions may be covered within your policy but you need to read the policy document to see exclusions. However, InsureMyDay states that you will not be covered for a pre-existing condition diagnosed within the last 12 months, for depression or anxiety, suicide attempts or acting against medical advise.

Are we covered for issues arising as a result of Covid-19?

InsureMyDay does not currently offer Covid-19 cover.

Do I really need wedding insurance?

If you are investing any amount of money into your wedding that you are not willing to lose then wedding insurance is important. This will cover any lost costs and will ensure that you are not in a financial deficit should anything go wrong.

Is my honeymoon covered under my wedding insurance policy?

Your honeymoon is not covered by your InsureMyDay policy. You will need to take out an appropriate type of travel insurance to cover this.

Will I still be covered if my wedding and reception are on different dates?

Yes, InsureMyDay allows you up to 31 days between the wedding and the reception and you’ll still be covered. However, the wedding must take place within two years of the policy purchase.