Wedinsure Wedding Insurance

Pros

- Great choice of ten levels of cover

- Easy claims process

- Nil Excess on Cancellation

- Personal liability up to £2m as standard

- COVID-19 extension available

- Cover starts from just £38.99

Cons

- Public Liability not included - Optional Extra

- Wedding abroad cover - Optional Extra

- COVID-19 cover - Optional Extra

Wedinsure Review – Wedding Insurance

The importance of a good wedding insurance policy cannot be understated. Imagine the devastation of finding out that your wedding cannot go ahead due to conditions outside of your control but you have no policy and have to cover the losses yourself.

The importance of a good wedding insurance policy cannot be understated. Imagine the devastation of finding out that your wedding cannot go ahead due to conditions outside of your control but you have no policy and have to cover the losses yourself.

Since weddings can cost tens of thousands of pounds, this isn’t something that you want to risk so finding a good insurance provider is a must. WedInsure has a 4.7 star rating on Feefo and is one of the more easily recognisable insurers. But what does their policy cover and how easy is it to make a claim?

I’ll be answering these questions and more in my WedInsure wedding insurance review.

WedInsure Wedding Insurance Overview

WedInsure wedding insurance offers cover for your big day starting from £38.99 which is pretty standard when you compare this to the price of cover across the board. The level of customer satisfaction is so great that WedInsure wedding insurance has even been voted the best during the Insurance Providers Awards of 2019.

What I particularly liked about this company was the choice when it comes to cover. Where a lot of insurance providers only offer four or five levels of cover, WedInsure offers a whopping ten! I feel as though this gives you a lot more choice and versatility.

The insurer has a lot of positive reviews including people talking about how easy it is to make a claim. Something I’ve noticed with some providers is that the claim process can be difficult, but it appears to be pretty straightforward with WedInsure.

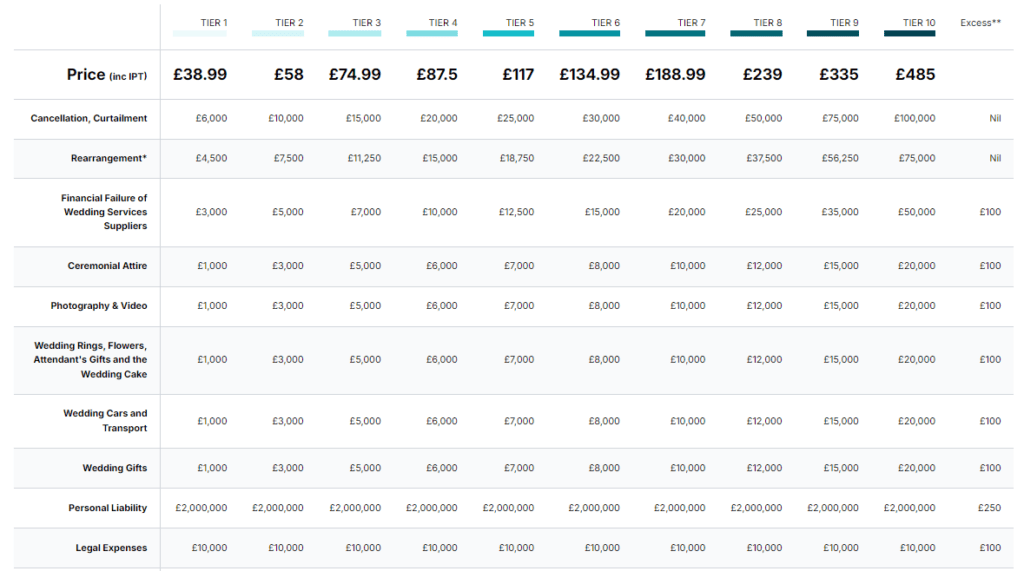

Levels Of Cover

As I have touched upon, WedInsure offers an impressive ten levels of cover with the cheapest starting at just £38.99. The policies are named according to their tier and Tier 10 comes with a premium of £485.

For this, you will get up to £100,000 in cancellation cover and £50,000 that covers the failure of suppliers. This is compared to just £6000 and £3000 respectively if you take out the Tier 1 cover. Of course, there are several options in between and which you choose will depend on the cost of your special day and what you require.

I was pleased to see that there is no excess charge should you need to cancel the wedding and that applies across all tiers. However, in all tiers, there is a standard £100 excess if you make a claim due to the failure of a supplier.

There will also be varying excess charges on other aspects of your policy including things like wedding attire, transport and gifts. However, you’ll need to check the website for more details on this.

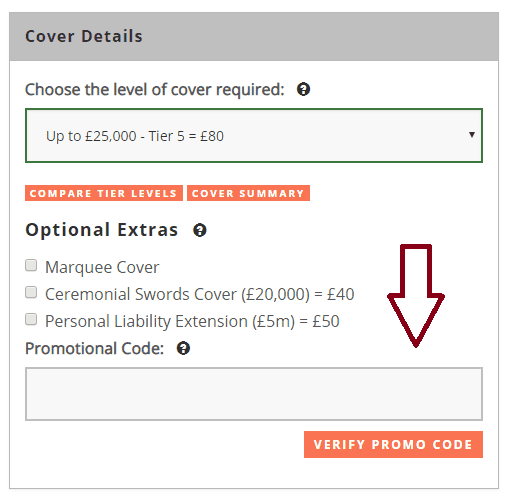

On each level of cover, there is an option to pay an additional premium for things like marquee and sword extensions and well as public liability up to £2 or £5 million.

What’s Covered By My Policy?

When you take out a WedInsure policy, you will be covered for the following things:

- Cancellation cover

- Failure of suppliers

- Wedding attire

- Photography and video

- Rings

- Flowers

- Attendant gifts

- Transport

- Wedding gifts

- Personal liability

As I discussed above, there is the option to pay an additional fee to add on things like public liability and marquee cover.

Understanding Your Wedinsure Policy

If you’ve ever read the policy documents for wedding insurance, then you’ll know that there’s a lot of legal jargon and phrases that may be difficult to understand. If you have any questions regarding your policy, then the customer service team at WedInsure will be more than happy to help. They’ve got excellent reviews and I think it’s really important to be clear on your policy before you sign or pay for anything.

Moreover, there is a section on the WedInsure website regarding documents. Although I was disappointed to see that there wasn’t a policy wording section which some other providers do have to make understanding certain terms easier.

Making A Claim

As far as I have seen, the process for making a claim with WedInsure is super simple. If your policy was taken out before March 2020 then the process is a little different but there’s a whole section dedicated to what you need to do on the WedInsure website.

Otherwise, it’s as simple as filling in a claim form and providing WedInsure with any relevant documents such as receipts. They’ll then do everything for you, but I would advise you to keep in mind that the length of time it takes to process your claim may vary depending on the circumstances.

To read full details of Wedinsure’s policy documents please click on the links below.

Wedinsure Pros and Cons

Wedinsure Promotional Codes and Voucher Codes:

Occasionally Wedinsure Insurance offer promotional codes and vouchers. If available the code will be displayed on this site and can be entered in the box shown below on the Wedinsure website.

There are currently no Wedinsure Promotional Codes available.

Wedinsure Cover limits and excess

| | TIER 1 | TIER 2 | TIER 3 | TIER 4 | TIER 5 | TIER 6 | TIER 7 | TIER 8 | TIER 9 | TIER 10 | Excess** |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Price (inc IPT) | £38.99 | £58 | £74.99 | £87.50 | £117 | £134.99 | £188.99 | £239 | £335 | £485 | Nil |

| Cancellation, Curtailment & Rearrangement* | £6,000 | £7,500 | £11,250 | £15,000 | £18,750 | £22,500 | £30,000 | £37,500 | £56,250 | £75,000 | Nil |

| Financial Failure of Wedding Services Suppliers | £3,000 | £5,000 | £7,000 | £10,000 | £12,500 | £15,000 | £20,000 | £25,000 | £35,000 | £50,000 | £100 |

| Ceremonial Attire | £1,000 | £3,000 | £5,000 | £6,000 | £7,000 | £8,000 | £10,000 | £12,000 | £15,000 | 202,000 | £100 |

| Photography & Video | £1,000 | £3,000 | £5,000 | £6,000 | £7,000 | £8,000 | £10,000 | £12,000 | £15,000 | £12,000 | £100 |

| Wedding Rings, Flowers, Attendant's Gifts and the Wedding Cake | £1,000 | £3,000 | £5,000 | £6,000 | £7,000 | £8,000 | £10,000 | £12,000 | £15,000 | £12,000 | £100 |

| Wedding Cars and Transport | £1,000 | £3,000 | £5,000 | £6,000 | £7,000 | £8,000 | £10,000 | £12,000 | £15,000 | £12,000 | £100 |

| Wedding Gifts | £1,000 | £3,000 | £5,000 | £6,000 | £7,000 | £8,000 | £10,000 | £12,000 | £15,000 | £12,000 | £100 |

| Personal Liability | £2m | £2m | £2m | £2m | £2m | £2m | £2m | £2m | £2m | £2m | £250 |

| Legal Expenses | £10,000 | £10,000 | £10,000 | £10,000 | £10,000 | £10,000 | £10,000 | £10,000 | £10,000 | £10,000 | £100 |

| Professional Counselling | £500 | £500 | £500 | £500 | £500 | £500 | £500 | £500 | £500 | £500 | Nil |

| Optional Public Liability Extension | £2m | £2m | £2m | £2m | £2m | £2m | £2m | £2m | £2m | £2m | £200 |

| Optional Marquee Extension | Up to £75,000 | Up to £75,000 | Up to £75,000 | Up to £75,000 | Up to £75,000 | Up to £75,000 | Up to £75,000 | Up to £75,000 | Up to £75,000 | Up to £75,000 | £200 |

| Optional Ceremonial Swords Extension | Up to £20,000 | Up to £20,000 | Up to £20,000 | Up to £20,000 | Up to £20,000 | Up to £20,000 | Up to £20,000 | Up to £20,000 | Up to £20,000 | Up to £20,000 | £200 |

Optional Public Liability Extension £2m or £5m (This cover only applies where the additional premium has been paid) Excess £200

Optional Marquee ExtensionUp to £75,000 (This cover only applies where the additional premium has been paid) Excess £200

Optional Ceremonial Swords ExtensionUp to £20,000 (This cover only applies where the additional premium has been paid)Excess £200

Optional COVID-19 Cover(This cover only applies where the additional premium has been paid) Excess As Above

Optional Wedding Abroad Cover(This cover only applies where the additional premium has been paid) Excess As Above

Optional Excess WaiverNil Excess Across all Sections of the policy (This cover only applies where the additional premium has been paid) Excess Nil

Conclusion

In summary, the Wedinsure Wedding Insurance has many satisfied customers. Their feedback scores highly in terms of good value, easy to apply, professional and pleasant customer service.

Wedinsure FAQs

Does WedInsure offer COVID-19 cover?

Any policy taken out after Jan 2023 can be covered for death, serious illness due to a confirmed COVID-19 diagnosis, which prevents participation and/or attendance as planned in the wedding. This is an optional extension to the cover. The cost of this optional cover varies depending on the level of cover you choose.

What level of wedding insurance do I need to buy?

The tier you choose when buying insurance from WedInsure will depend on the total value of your wedding. It’s important to add up all costs and ensure that you choose a policy that will cover all of these.

Am I covered for cancellation due to pregnancy?

Your WedInsure policy will not cover the cost of any losses should you cancel your wedding due to pregnancy. However, if your due date is more than five months after the date of the wedding and you have to cancel due to a pregnancy related illness, you may be able to make a claim.

Does WedInsure offer cover for weddings taking place abroad?

Yes, WedInsure is a UK provider that offers cover for weddings taking place outside the United Kingdom. However, you will need to add this optional extra to your cover when taking out your wedding insurance with Wedinsure. The cost of this optional cover varies depending on the level of cover you choose.

Will my insurance cover my wedding and reception if they are on different dates?

Your WedInsure cover allows you up to 31 days between the wedding and the wedding reception so as long as you hold them both within this time period, you will be covered.

Does WedInsure cover civil partnerships?

Yes, WedInsure covers civil partnerships and any associated receptions.