CoverMyWedding Wedding Insurance

Pros

- Four levels of cover to choose from

- Up to £50,000 in cancellation cover

- Available in the UK and Ireland - Optional overseas weddings cover

- Cover starts from just £49

Cons

- Trustpilot reviews state that some customers have had problems with customer service.

- Excess amount remains the same on all levels of cover

Getting married is supposed to be one of the most exciting times of your life but with the potential for great financial loss, it can turn into a nightmare for some couples. But that isn’t a problem if you take out wedding insurance as you’ll be covered in the event that the wedding has to be cancelled, rearranged or if any damage should occur to things like rings, dresses, gifts and much more.

CoverMyWedding Wedding Insurance Overview

CoverMyWedding is a small, UK based company offering wedding insurance on ceremonies taking place in the United Kingdom and the Republic of Ireland.

The company offers a variety of cover levels to suit different needs with their top package providing you with up to £40,000 worth of cancellation cover as well as a range of other benefits.

You’ll be covered for things like illness or the death of a wedding party member, adverse weather that causes you to postpone your big day, attire, car and photography cover as well as things like personal and public liability, depending on the level of cover you take out.

However, there are some things that are not covered such as the cost of an engagement ring or any honeymoon costs or travel insurance after the wedding. Therefore, it’s important to read through the following information to find out if CoverMyWedding is the right fit for you.

Levels Of Cover

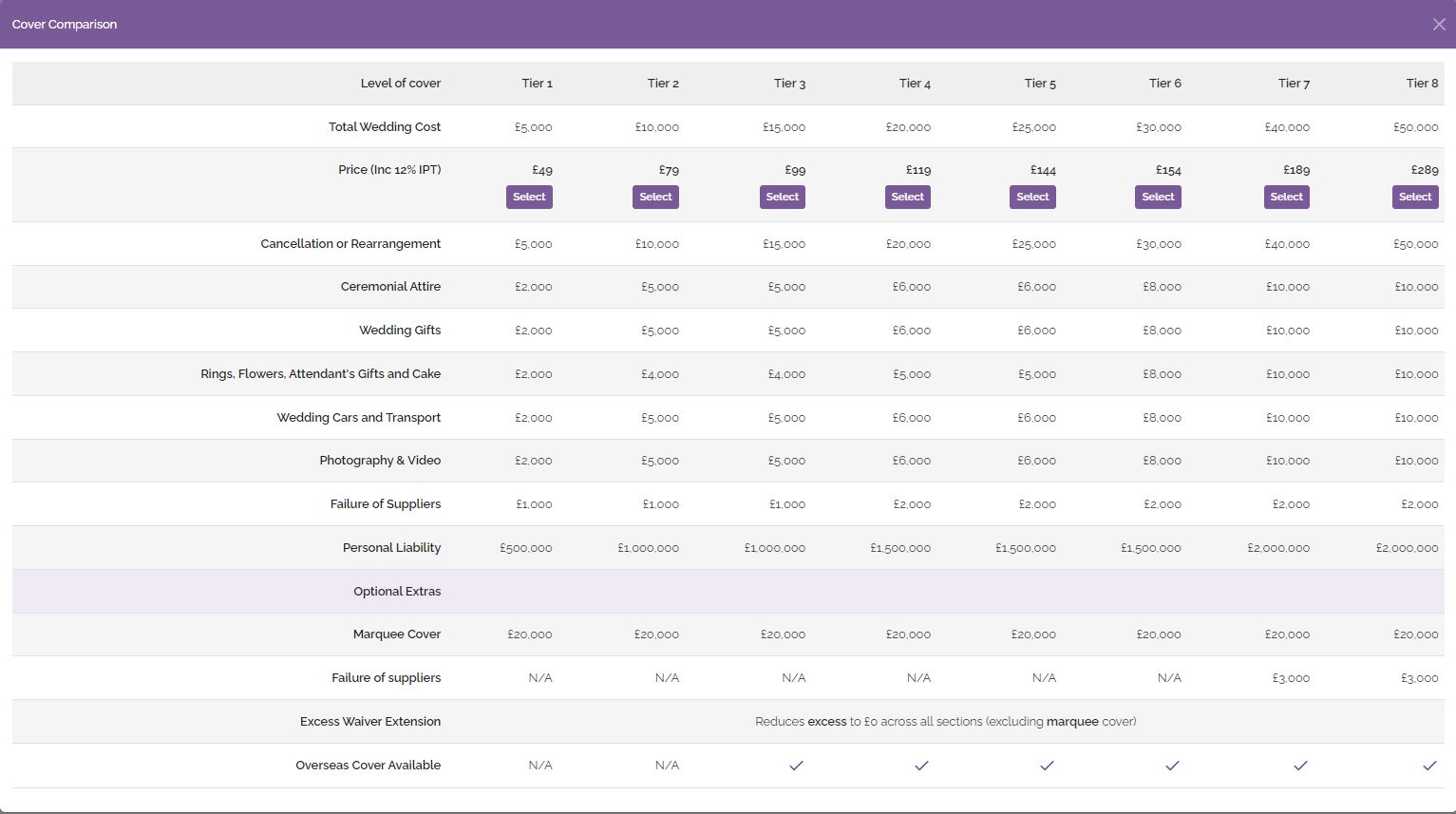

There are eight levels of cover offered by CoverMyWedding which range between £49 and £289. At the lower end of the scale, you’ll be covered up to £5000 whereas the top package offers up to £50,000. Do keep in mind that this applies to only 75% of the total cost of the wedding in the event that you have to rearrange.

Each level of cover also provides you with cover up to a certain limit for things like bridal attire, gifts, rings, transport and many other costs. These limits are listed on the cover levels page of the CoverMyWedding website where you can find out more information.

What Is Covered By My Policy?

When assessing what CoverMyWedding had to offer, I was pleased to see that you get everything you would expect from a wedding insurance policy. While the amount of cover you will receive for each of the following things will differ depending on which policy you have taken out, all policies cover the same things. The only exception is that the lowest level policy does not offer extended public liability.

- Cancellation cover

- Ceremonial or bridal attire

- Wedding gifts

- Transport

- Rings

- Wedding cake

- Flowers

- Attendant gifts

- Failure of suppliers

- Video and photography

- Personal liability

- Optional extended public liability

- Optional marquee extension

- Optional overseas cover

Understanding Your Policy

One of the things that I found very handy on the CoverMyWedding website was the Policy Documents page which included a helpful PDF of policy wording. It’s really important to be able to get to grips with all that legal jargon and those fancy phrases and this document helps to shed a little light on what everything means.

Also understand that you have a 14 day cooling off period wherein you can cancel your policy without any fees, should you change your mind. However, that isn’t to say that you’ll be automatically entitled to a refund for anything you have already paid so please speak to customer services regarding your situation.

CoverMyWedding Policy & Tier Chart

Making A Claim

In the unfortunate event that you need to make a claim on your wedding insurance, all of the information you need is on the CoverMyWedding website. There is a postal address, email address and telephone number for contact but I do think that the addition of a webchat would be great in the future.

However, due to the many reviews of poor customer service and phone calls not being answered or returned, this would give me pause for thought before taking out a policy.

What Are The Pros and Cons Of CoverMyWedding Wedding Insurance?

CoverMyWedding Promotional Codes and Voucher Codes:

CoverMyWedding FAQs

Do I really need CoverMyWedding wedding insurance?

A wedding costs a lot of money and if anything goes wrong, there’s a chance of losing deposits or money you have spent on things like outfits. This can be a substantial loss so having wedding insurance protects the financial side of your big day. Plus, since premiums are very affordable, it’s something I’d recommend every time.

When should I take out CoverMyWedding wedding insurance?

As soon as you have set the date for your special day, it’s time to take out wedding insurance.

Does my CoverMyWedding policy cover COVID-19?

Claims associated either directly or indirectly with COVID-19 are not covered by your CoverMyWedding policy. However, there may be exceptions if this is offered under Section 1: Part A Cancellation of your policy so please read your documents carefully.

Can I amend my policy?

If there’s something you need to change in your policy, you can call the team at CoverMyWedding who will be happy to talk through your needs.

Will I need to pay an excess if I make a claim?

Yes, CoverMyWedding charges a £35 excess on all claims. However, the marquee extension excess fee is £100.

Am I covered if my partner decides not to go through with the wedding?

Your CoverMyWedding wedding insurance policy covers unexpected events that are beyond yours or anyone else’s control. However, your policy will not cover any losses associated with one party voluntarily deciding that they no longer wish to get married.

Will my CoverMyWedding policy cover my wedding if it is abroad?

For policies starting at Tier 3, CoverMyWedding offers an optional overseas wedding cover extension.